Best-In-Class Onboarding and Client Lifecycle Management for Corporate Banks

Book a DemoTransform Corporate Banking Compliance from Burden to Growth Opportunity

Optimize Onboarding & Customer Experience for Corporate Clients

Siron®One makes it easy to onboard corporate clients with streamlined digital processes, risk-based due diligence, and third-party verifications, significantly reducing the onboarding time.

Create a Single Client View with Golden Source of Data

Disparate sources and poor-quality of client data make it difficult to get a complete view of the customer and affect risk scores. Siron®One’s Document Management capability helps you organize, process, share and govern all your files and information in electronic folders to create a golden source of data for better insights and quicker decisions.

Understand Complex Business Structures & Ownerships

Complex business structures make establishing ultimate beneficial owners (UBOs) challenging. Siron®One link analysis unravels complex shareholder structures to identify individuals or entities that directly or indirectly own or control and perform the appropriate verifications.

Improve Lifecycle Management with Ongoing Dynamic KYC

Changes in client profiles or contract agreements can pose both risks and opportunities. Siron®One business rules editor lets you define dynamic controls to manage changes in risk profiles, automatically triggering continuous event-based KYC when thresholds are crossed.

Mitigate Risks Across Corporate Networks Through Comprehensive KYC & AML Monitoring

Establishing transparency across a corporate ecosystem involving vendors, suppliers, partners, and respondent banks is challenging. Siron®One conducts third-party KYC and correspondent banking AML to mitigate risks such as trade-based money laundering (TBML) while ensuring compliance with cross-border and foreign exchange service regulations.

Corporate Banking KYC & AML Software Trusted by Leading Corporate Banks Worldwide

Leading business banks around the world already use Siron®One to meet their end-to-end compliance requirements, safeguard their customers’ trust, and protect their reputation.

Onboarding KYC

Siron®One Digital Onboarding Solution is a category leader capable of handling complex private and corporate banking KYC for light, medium, or complex onboarding processes.

Continuous KYC

Siron®One continuous KYC is event-based and automatic using AI, giving you high-quality risk scores and alerts with little intervention or cost.

Adverse Media

Siron®One gathers and manages corroborative evidence through multi-source screening, including Open Source (Google API) and Factiva.

Sanctions Screening and Evasion

Siron®One conducts real-time sanctions screening to prevent evasion and is connected to the ICIJ Offshore Leaks Database to check people and entities against offshore lists.

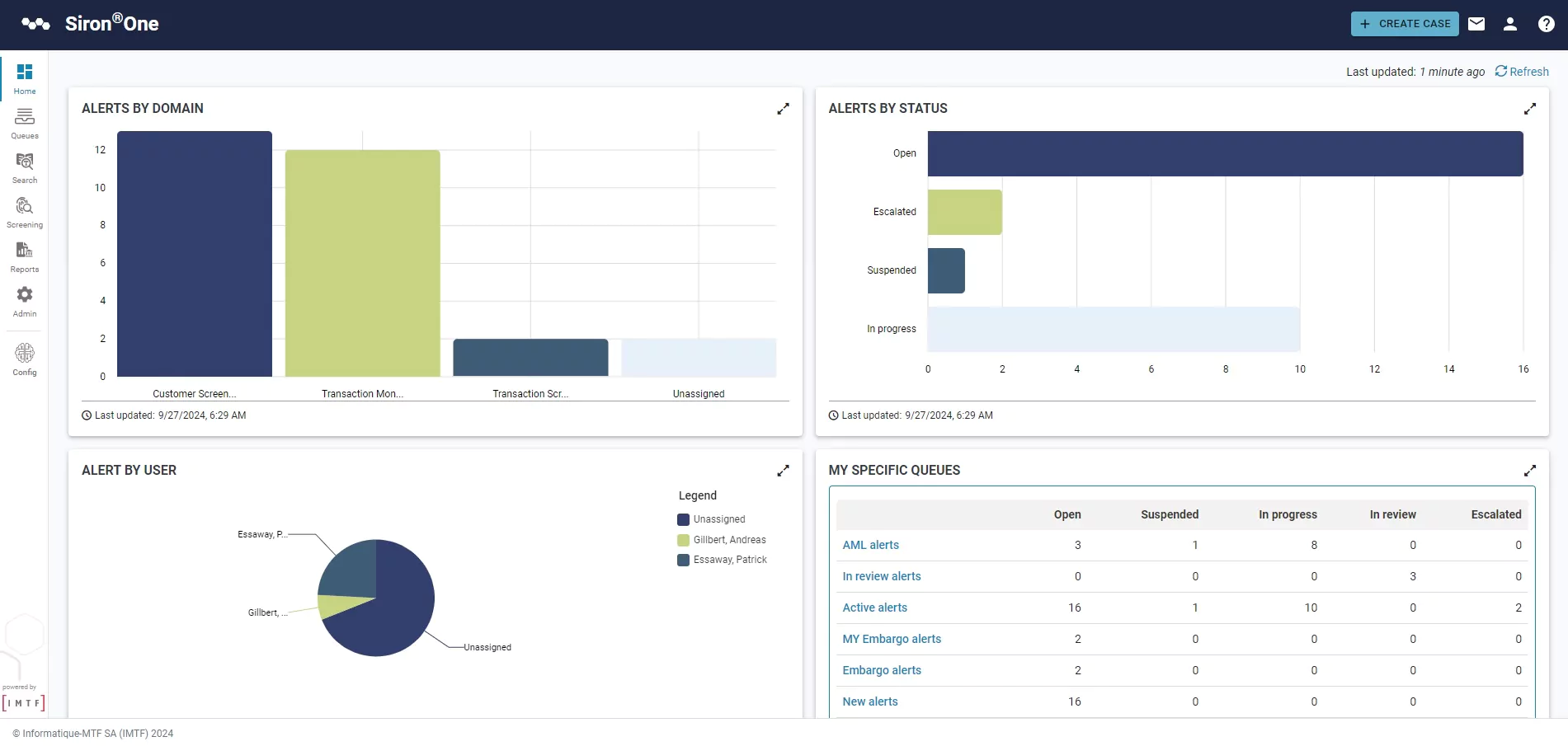

Transaction Monitoring

Siron®One’s transaction monitoring detects and prevents suspicious activities, reduces false positives, and automatically fills regulatory reports to save you time and effort.

Correspondent Banking

Siron®One automatically initiates KYC due diligence of all respondent banks to prevent exposure to money laundering or terrorist financing risks.

TBML

Siron®One uses AI to monitor global transactions, ensure trade financing arrangements are legitimate and compliant across jurisdictions.

Real-Time AML

Siron®One utilizes AI-based entity behavioral clustering, entity deviation score, alert prediction score, intelligent name screening, and economic network analytics to instantly detect anomalies and suspicious activity.

Tax Compliance Reporting

Automatically fill out standard tax documents from captured data. No need to fill out overlapping information across different tax forms, such as FATCA and CRS.

Over the past 20+ years, IMTF has empowered leading corporate banks worldwide to manage compliance and reduce costs.

Trusted by Corporate Banking Leaders

Société Générale, UniCredit, Nord/LB, and many more rely on IMTF Siron®One for their corporate banking compliance.

Integrated Platform for End-to-End Compliance

Siron®One can be tailored to your exact requirements so you can manage all compliance processes from one platform.

Improve Compliance While Cutting Costs

Siron®One’s AI and RPA automate repetitive tasks like transaction monitoring while ML and predictive analytics detect changes in risk scores for quick action.

Operate Worldwide with Any Number of Customers

IMTF has 35+ years of experience working with Tier 1, 2, and 3 financial institutions that operate across multiple jurisdictions.