Siron®One

A single platform to manage all your regulatory compliance needs

A modern compliance platform to fight financial crime. We use state-of-the-art technology and in-depth knowledge to monitor business activities and generate value.

Key Benefits

Cost Efficiency

Automate processes and speed up compliance tasks to focus on the core of your business. Our solutions help reduce your costs and avoid financial losses.

Innovation

Let technology do what it should: more accurate risk and profile calculations to reduce false positives and ensure you get the most accurate KYC picture of your customers.

Modularity

Modular and scalable software solution: you can start with a module that addresses your biggest pain point and add additional capabilities when the time is right for you.

No-code: all the way

We want to build software to make you more efficient, which is why we embrace “no-code”. You are able to manage your own configuration without having to write a single line of code.

From activating and configuring new compliance scenarios to building workflows or tasks - everything without having to call us or involve your own IT. Your business and compliance experts can themselves work on advancing your systems, without having to translate everything for IT specialists.

User Experience to make you more efficient

Our experts are in the process of re-thinking user experience from the ground, talking to hundreds of customers and coming up with new and unimagined ways to improve your operations

Machine Learning

We truly believe that machine learning and artificial intelligence can significantly enhance the quality of the software and have been investing in these capabilities for the past several years.

Reducing false positives, increasing precision or discovering unknows patterns are only a few of many promising features and applications we are working on to make your operations more efficient and compliant.

The future of Siron is exciting, and we are heavily investing to bring you the features that will help you stay compliant with less human effort, an improved user experience and the ability to profit from new technological advances.

Sandro Pelaez

Head of Product

Siron Platform Modules

Siron AML

Anti-Money Laundering

Siron AML is a best-in-class solution to fight money laundering with an advanced analytics solution. It allows to identify and report suspicious activities, to better understand customers, relationships, and behavioural changes.

It combines powerful analytics and machine learning (AI) to reduce alerts to those with the highest relevance and allows to automate investigation and decisioning processes with process automation to increase efficiency and lower costs.

Siron KYC

Know Your Customer

Siron KYC provides Business Partner Due Diligence and complete lifecycle assessment of customer risk as part of your onboarding process and ongoing customer monitoring.

It offers Business Partner Screening (sanction scan / PEP check) and includes dynamic questionnaire capturing, ongoing checks, risk rating and workflow-based case management.

Watch-list management with standard adapters to all major databases is integrated.

Siron RCC

Reporting Compliance Cockpit

Siron RCC provides financial institutions with a complete company-wide overview of the status and effectiveness of their activities in the fight against financial crime.

It consolidates and visualizes all information necessary in one management cockpit, delivering daily updated data on compliance activities. It helps determine the current status, shows the need for action, gives users the ability to determine specific key performance indicators, monitor them and show the effectiveness of the measures.

Siron Embargo

Sanction Filtering

Siron Embargo is the “sanction filtering” module enabling real-time screening of your SWIFT, SEPA and other payments against multiple watch-lists (OFAC, BoE, UN, World-Check, etc.) ensuring that individuals, groups, and organizations on whom sanctions have been imposed can no longer access financial services, resources or instruments.

Siron Embargo complies with the latest FATF recommendations.

Siron ACM

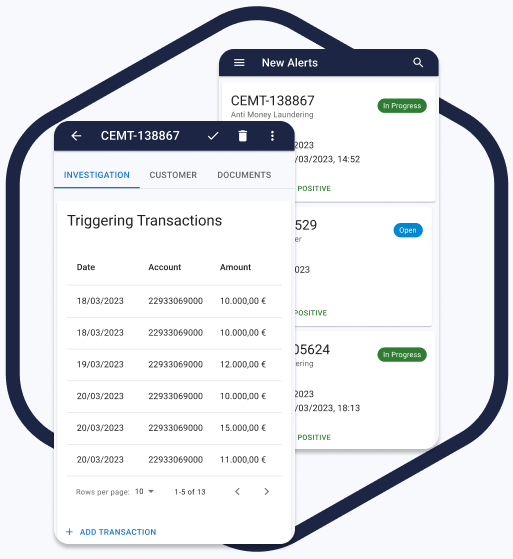

Alert and Case Management

The alert and case management module provides a single environment to manage financial crime compliance alerts, allowing compliance officers to handle alerts from the “source systems” Siron AML, Siron KYC and Siron Embargo and to investigate the details for decision making and to file Suspicious Activity Reports (SARs) to the local authorities.

Siron ACM supports this process with integrated workflow as well as task queuing capabilities.

Siron RAS

Risk Assessment

Siron RAS is an application for the creation of an institution-specific risk analysis, taking into account the business environment, products, processes, etc.

The functional definition of risk in Siron RAS is based on the “guideline for generating a threat/risk analysis” provided by some legal authorities in Europe, and supports AML officers with complete and continuous management of a threat analysis.

Siron TCR

Tax Compliance & Reporting

Siron TCR is the module for a successful & fast implementation of FATCA and OECD CRS tax reporting requirements at banks & insurances. This innovative module integrates seamlessly with your IT environments & helps to comply with IRS FATCA & OECD CRS regulations (Automatic Information Exchange. The reporting component enables secure data transfer to IRS & national tax authorities.

Downloads

Click the links to download Siron brochures:

Siron AML

Download

Siron KYC

Download

Siron ACM

Download

Siron Embargo

Download

Download the IMTF RegTech Platform brochure